At no added cost to you, some of the products mentioned below are advertising partners and may pay us a commission.

This blog has partnered with CardRatings for our coverage of credit card products. This site and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author's alone and have not been reviewed, endorsed or approved by any of these entities.

We may receive commission from card issuers. Some or all of the card offers that appear on the WalletHacks.com are from advertisers and may impact how and where card products appear on the site. WalletHacks.com does not include all card companies or all available card offers.

As an Amazon Associate, I earn from qualifying purchases. More information

If you have a Citi Costco credit card, you’ve been earning some great rewards all year.

I love the card because you get 4% at gas stations (first $7,000 each year), 3% at restaurants, 2% from Costco and Costco.com, and 1% everywhere else.

What I don’t love as much about the card is that you get your rewards once a year, usually in your February statement. It would be nice if the rewards were just deposited as cashback each month, but I suppose this does seem like a more frugal option… which is in line with Costco’s brand.

Normally, you can redeem the certificate at the Costco cash register. If your certificate is over $300, you can also opt to direct deposit the certificate – a really nice feature.

We do a ton of our shopping at Costco and with four kids, this means we get a pretty sizable check from Costco – way more than $300. (we also put our gas and restaurant spending on the card too!)

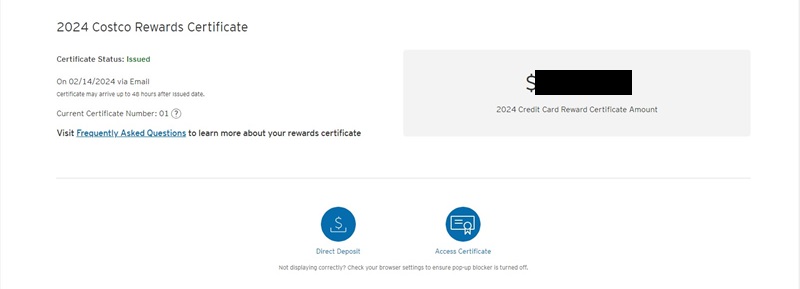

To get your reward certificate direct deposited, log into your Citi account and scroll down until you see this part of the screen:

When your certificate is ready, the Certificate Status will say Issued. You will also get an email that contains your certificate’s bar code.

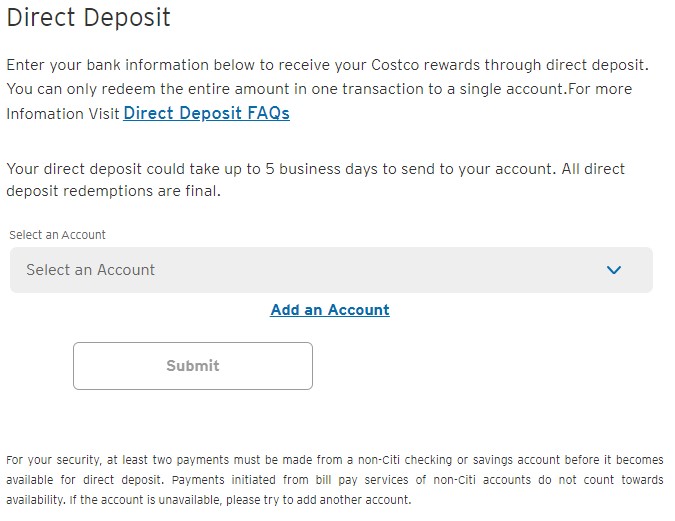

At this point, you can click on Direct Deposit and it’ll reveal this screen:

If you haven’t added your bank, you can click Add an Account and and you’ll be prompted to add your back via Plaid. If it’s a non-Citi account, they require two payments from it before they’ll accept it for direct deposit.

Otherwise, you can select your bank and click redeem.

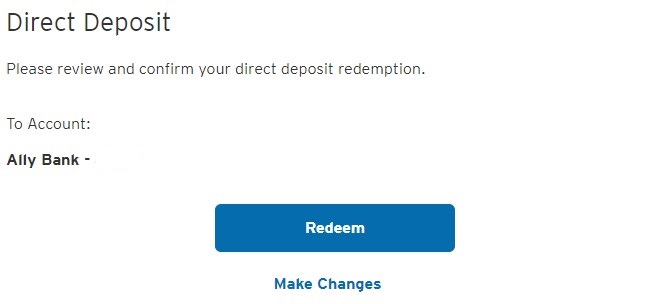

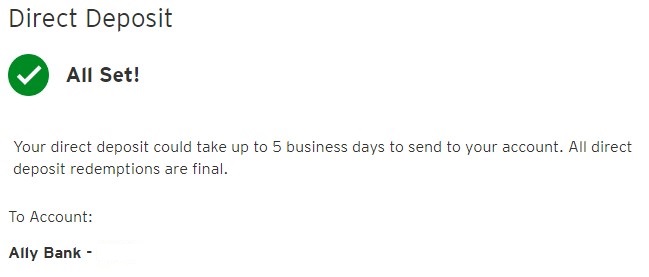

Once you click redeem, you’re shown this confirmation screen:

That’s it! Super easy.

If you want to redeem your certificate in the warehouse, simply bring it to the cash register. You cannot redeem it at Customer Service.

Just note that they will pay you the reward from the cash register so if it’s a really large reward certificate, it’s better to get it direct deposited. Or, wait for a larger shopping trip so you can use the certificate on the purchase and get what’s left over.

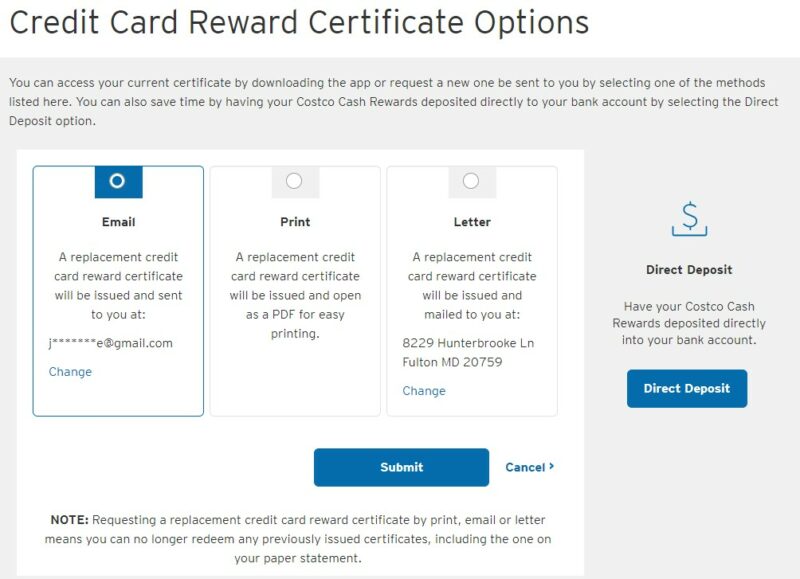

If you lost your certificate, you can always log into your Citi account and get it reprinted. Just click on Access Certificate and this screen will appear:

Requesting a new one will invalidate previous ones, as they will invalidate the bar code.

Remember to redeem your certificate before the end of the year! The certificates expire on 12/31/2024 and there’s nothing you can do if you forget.

Also, only you and any authorized users will be allowed to redeem it. You have to show your card at the register anyway so this is usually not a problem… but note that you can’t give it to a friend.

I’ve never tried redeeming it at the self-checkout but I’d suspect you can’t get it redeemed there.

Finally, if you didn’t get a certificate this year, they will only issue it if you’ve been a member for at least a year. If you signed up last year but after the last certificate, unfortunately you’ll have to wait an additional year. I don’t know why this rule exists but that’s one reason why.

Investing does NOT have to be complicated but society (and our minds) seems to want it to be. That's because their incentives are not aligned with yours. Investing doesn't have to be complex or difficult, here's how to do it simply but effectively.

Want to know the best airline and hotel transfer bonuses available right now? We will keep track of the best transfer bonuses so you can get the maximum value for your points and miles.

It's back to school season and many states have sales tax holidays to help lower the cost of many of these items. We list the states and the sales that are still left for this year.

There are Winner's Games and Loser's Games, and sometimes there are games that start as Loser's Games and become Winner's Games. Personal Finance is a Loser's Game - you win by avoiding mistakes, not by making spectacular shots. Learn the difference and how you can win at money today.

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard's Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology - Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here's my treasure chest of tools, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you're on track to retire when you want. It's free.

Opinions expressed here are the author's alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.